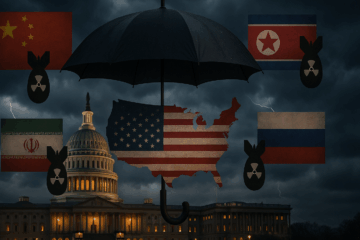

The volatility of cryptocurrency markets has been a major topic of discussion since the inception of digital assets like Bitcoin and Ethereum. Its impact extends beyond financial speculation and the promise of decentralized finance. Cryptocurrency’s creation is creating distinct ripples through the global economy, even reaching security and geopolitical affairs. Among the more intriguing dimensions of this impact is the interplay between cryptocurrency volatility and nuclear deterrence.

Too few Americans contemplate the role of digital currency volatility in acting as a barrier or an enabler to nuclear deterrence. The reality is that there are opportunities and risks that volatile cryptocurrency plays in the strategic calculus of nuclear states.

Cryptocurrency and Geopolitical Shifts

Cryptocurrencies are decentralized and borderless, challenging traditional financial systems and reshaping how states interact economically. Their volatility stems from market immaturity, speculative trading, regulatory uncertainties, and evolution of these ever-changing technologies. Essentially created to prevent intermediaries, like banks and financial institutions, cryptocurrencies lay the foundation for trustless transactions for illicit activities.

This volatile mix of person-to-person transactions and zero oversight introduces both unpredictability and opportunity, raising questions about their implications for nuclear deterrence, which now must deal with a domain that includes ungoverned access to financial streams that can be used by state and non-state actors to engage in elicit behavior that undermines deterrence stability.

Nuclear deterrence relies on a delicate balance of power, with states maintaining assured second-strike capabilities to dissuade adversaries from initiating conflict. This balance hinges on credibility and capability. Cryptocurrencies, with their volatile swings in value, could serve to undermine stability within a country or enable elicit actors to engage in a range of nonnuclear actions that undermine strategic stability.

The Risks of Cryptocurrency Volatility as a Barrier

Cryptocurrency volatility can act as a barrier to nuclear deterrence by creating financial instability and undermining a state’s ability to project economic power. Traditional nuclear powers depend on stable economies to maintain robust defense capabilities, fund deterrence strategies, and support diplomatic efforts. Sharp and unpredictable fluctuations in digital assets can undermine financial stability, weakening a state’s capacity to fund critical defense initiatives.

For the United States, crypto is not a major issue currently. But, for North Korea, who funds its nuclear program through elicit activities, crypto is important. Proliferators also use crypto to conduct activity. Instability in crypto makes illicit activity even more high stakes and unpredictable.

Instability creates advantages for state and non-state actors to exploit cryptocurrency markets for nefarious purposes, such as evading sanctions, financing proliferation, and bypassing traditional financial controls. The decentralized nature of cryptocurrencies complicates efforts to monitor, track, and regulate illicit activities, potentially undermining efforts to prevent the spread of nuclear weapons or restrict financing for state and non-state actors pursuing destabilizing weapons programs.

Cryptocurrency instability also presents a challenge to strategic stability through cyber threats. If critical financial systems or exchanges are disrupted, or if adversaries manipulate markets to harm a nation’s economy, it could create economic shocks severe enough to destabilize deterrence relationships, increase miscalculation risks, or fuel insecurity-driven arms build-ups.

The Darknet and Conflict Escalation

Darknet cryptocurrency markets empower bad actors by offering anonymity and decentralized financial tools, enabling a wide range of conflict-escalating activities. These markets facilitate the purchase of illegal arms, military-grade technology, and hacking tools, often used to destabilize regions and target critical infrastructure (command-and-control systems) through cyberattacks.

Terror organizations leverage cryptocurrencies for anonymous funding, allowing them to finance operations, recruit globally, and expand their influence. Sanctioned entities exploit these markets to bypass international restrictions and acquire resources that fuel aggressive actions.

The ability to transact anonymously with cryptocurrencies also shields organized crime, including narcotics and human trafficking, whose revenues often fund conflict zones and insurgent groups. Covert exchanges on the darknet can increase espionage, destabilize international relations, and provoke hostilities to serve a radically motivated agenda.

In parallel, extremist groups utilize these platforms to spread propaganda, incite violence, and radicalize populations, further destabilizing fragile regions. The combination of anonymity, decentralized systems, and hidden economies presents a formidable challenge for global security efforts aimed at conflict prevention and stability.

Cryptocurrency as an Enabler of Nuclear Deterrence

On the other hand, cryptocurrency volatility also opens new avenues for strengthening nuclear deterrence through financial resilience and innovation. The decentralized nature of digital assets can enable states to diversify their financial resources and reduce dependency on traditional systems that might be vulnerable to adversarial influence or geopolitical tensions. In times of economic crisis or sanctions, cryptocurrencies can provide states with alternative means to maintain fiscal stability, thus supporting their deterrent capabilities. Countering bad activities with good can be as challenging as the reliance on traditional financial stability for positive security assurance.

Furthermore, blockchain technology, which underpins cryptocurrencies, offers potential for transparency, accountability, and verification mechanisms in arms control agreements. By leveraging blockchain, states can create tamper-proof records for tracking nuclear materials, enhancing verification regimes, and building trust between adversaries. The volatility of digital assets may fuel innovation and drive investment into these applications, ultimately strengthening nuclear stability and deterrence structures.

Balancing the Risks and Opportunities

While the volatility of cryptocurrencies poses undeniable risks, it is essential to approach them with a nuanced perspective to find the right balance between risk and reward. Policymakers must strike a balance between leveraging the opportunities that digital assets present and mitigating their risks to global security. Collaborative efforts to regulate and stabilize cryptocurrency markets can reduce the likelihood of financial instability while harnessing the potential of decentralized systems.

In addition, enhanced cybersecurity measures must accompany any state or multilateral effort to integrate cryptocurrency into the financial systems that underpin deterrence capabilities. Protecting digital infrastructure against malicious actors will ensure that the advantages of decentralized assets are not overshadowed by their exploitation for destabilizing purposes.

A New Strategic Frontier

The volatility of cryptocurrency markets is both a challenge and a frontier for instability of nuclear deterrence. While it poses risks through financial instability, illicit use, and cyber threats, it also offers opportunities for financial resilience, innovation, and transparency. In today’s evolving digital environment, nations must adapt to this dual-edged sword, developing strategies that incorporate the volatility of digital assets into a comprehensive approach to deterrence.

Ultimately, whether cryptocurrencies become a barrier or enabler of nuclear deterrence depends on how nations, regions, and regulators in the broader international community respond to this evolving challenge. By advocating cooperation, innovation, and regulation, cryptocurrencies can strengthen global security architectures and contribute to a stable nuclear order—turning volatility into a force for strategic stability and peace.

Greg Sharpe is the Marketing and Communications Director at the National Institute for Deterrence Studies. The views expressed in this article are his own.

About the Author

Greg Sharpe

Mr. Greg Sharpe is the director of Communications and Marketing for the National Institute for Deterrence Studies and the Managing Design Editor for the Global Security Review.

He has 25+ years in marketing and communications focusing in digital marketing and analysis. Greg has over 35 years of military, federal civilian and defense contractor experience in the fields of database development, digital marketing & analytics, and organizational outreach and engagement.

Greg, I read with great interest your fair and balanced assessment, much appreciated. This all happens at the intersection of cybersecurity forensics, dark web criminal activities, and digital money laundering. Which then meet WMD-related traffic. It’s fair to say there is an arms race aspect in all that, cycles of measures and counter-measures. However bad guys make mistakes too. Cryptocurrencies aren’t anonymous, at best they are pseudonymous. With DLT (Decentralised Ledger Tech, including blockchain) everything is traceable. Even if a user is an ultimate pro at cyber stealth, this user will inevitably leave a digital trail. Purely decentralised mechanisms are relatively harder to monitor, whereas a centralized 3rd party is also a single point of failure if law enforcement can get to them. Also, this digital cat-and-mouse game is pretty much connected to a physical hardware network: servers, computers, comms providers, and other infrastructures can be effectively monitored, the data logs and activities dissected, exposing the who, what, how, when, and where’s. Using a chain of VPNs is almost naive despite the hype, that’s paradoxically a quick way to attract attention. Every movement on any crypto currency ledger / blockchain is traceable. Using privacy coins isn’t a panacea. Decentralised mixers are a bit harder to investigate, but put your boot on the throat of a centralised mixer and a gazillion of fraudulent users will be nailed immediately. Paradoxically, nothing really beats a suitcase or truck of cash carried or driven by a mule and without your own fingerprints on it. Of course, rogue countries, terrorists, and other criminal networks are neither naive nor stupid. They employ “the best and the brightest” that have gone to the Dark Side. Sometimes, if you get someone back to the lawful side, it helps everyone involved against adversaries. But it’s a real war, blood is spilled and a lot of black hat nerds can end up dead, while it’s also a risky job for law enforcement and special operations. That aspect of cyber warfare may only further increase, and spill over all domains of economy and security, including space. I’m not sure how you can deter that. We live in interesting times. Here are a few links to get a more concrete sense of this arms race aspect. / / / / / / and the best for last, Implications of Cryptocurrencies for Special Operations Forces

This is a very informative discussion. For one thing, it looks like cryptocurrency gives bad actors yet another way to anonymously fund nefarious activities of all kinds, and even when their identity is known gives another way to evade U.S. financial surveillance and anti-money-laundering measures. For another, crypto market price manipulation could provide a new weapon for hybrid warfare, destabilizing targeted economies just as Greg Sharpe says, by creating or exacerbating market bubbles and panics, especially when combined with AI-driven manipulative disinformation on social media platforms. That disinfo could be well funded, in particular, via cryptocurrency payments that cannot be traced to their source.

Nuclear proliferation and nuclear terrorism become harder to interdict: Imagine the late A Q Khan’s nuclear underground, but in today’s world that now has crypto. Also, “nuclear psychosis” (fear of one’s own country’s nuclear triad) could be further fomented by crypto-funded spreading of lies and myths about America’s nuclear modernization, eroding political support for said essential modernization in favor of budget cuts with more misguided pleas for unilateral U.S. nuclear disarmament….. Not a pretty picture.